HOME EQUITY SPECIAL

Unlock the Potential of Your Home Equity!

Are you ready to tap into the value of your home? Look no further than our Home Equity Line of Credit (HELOC) Special!

At METRO, we’re dedicated to helping you achieve your financial goals with ease and affordability.

For a limited time only, take advantage of our incredible offer:

🏡 Rate Reduction: Enjoy a 1.00% reduction in interest rate for the entire duration of your loan!

💰 Processing Fees Slashed: Processing fees reduced to just $199 (non-refundable)!

With our HELOC special, you can access the equity in your home to finance home improvements, consolidate debt, cover unexpected expenses, and more. Plus, with our competitive rates and flexible term, you’ll have the peace of mind knowing you’re getting the best deal possible.

Don’t miss out on this opportunity to make your dreams a reality! Contact us today at 847-670-0456 to learn more, or apply online. Take the first step towards financial empowerment with METRO!

*Terms and conditions apply. Offer valid for a limited time only. Rate reduction of 1.00% applies to the life of the loan. Processing fees reduced to $199, which is non-refundable. Subject to credit approval.

Book your loan now and take advantage of this great offer! Your reduced rate is only available through June 30, 2024.

Act NOW – Apply Online! Please contact Gabby or Ryan in METRO’s Loan Department at 847-670-0456, ext. 2, with any questions.

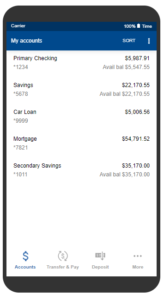

Please click here to view FIXED Home Equity Rates.

ADDITIONAL TERMS:

*Up to 80% Loan-to-Value financing based on qualification. Processing fee is non-refundable and due after initial loan preapproval. You can avoid the annual Home Equity Line-of-Credit fee by maintaining a loan balance or performing an advance at least once per year. Loan applications are subject to METRO’s lending guidelines. The final rate is based on credit score and mortgage position. The Home Equity Line-of-Credit annual percentage rate is based on Prime Rates plus an added margin. The rate is subject to change January 1st and July 1st each year. The prime rate is currently 8.50% as published in the Wall Street Journal as of July 27, 2023. Minimum monthly payment is $100. Property values are based on the lesser of the current appraised value or a Freddie Mac Home Value Explorer (HVE®) with a condition report. Independent appraisals not accepted. Consult your tax advisor regarding tax-deductible interest. Offer valid through June 30, 2024. Rates subject to change. Savings account is required for credit union membership.