Loan Promotions

Apply Online Today!

- Download our Fillable Loan Application (PDF) (Fax to METRO at 847-670-0401)

- Auto Loan Rates

Consolidate and Conquer Your Debt!

Are mounting debts causing you stress? Take control with our exclusive Debt Consolidation Loan Special! At METRO, we’re here to help you simplify your finances and achieve your financial goals.

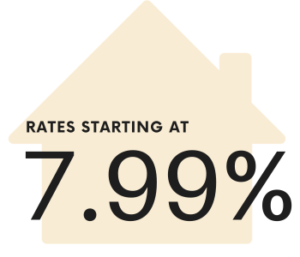

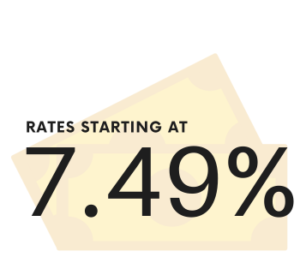

Two Special Offers:

Why Choose our Debt Consolidation Loan?

*Single Monthly Payment! Combine multiple debts into one easy-to-manage monthly payment.

*Lower Interest Rates! Take advantage of our competitive rates to save you money on interest.

*Financial Peace of Mind! Simplify your finances and focus on what matters most!

*Personalized Service! Our friendly team is here to guide you through the process.

How to Apply:

- Visit our branch at 2440 E Rand Road, Arlington Heights, IL 60004 to speak with a friendly loan officer.

- Call our Loan Department at 847-670-0456, ext. 2, for personalized assistance.

- Apply online at www.mcu.org for a quick and convenient application process.

Don’t let debt control your life. Take the first step

towards financial freedom with METRO today!

Don’t miss out on this exclusive opportunity to streamline your debts and regain control of your financial future. Our Debt Consolidation Loan special is available for a limited time only, so act now to secure these fantastic rates!

With METRO you’ll always find:

- A Trusted Partner: Serving the community with financial expertise for over 50 Years.

- Low Rates: Competitive APRs to save you money on interest.

- Local Commitment: We understand your unique financial needs as a member of our community.

Terms & Disclosures:

Special terms are available 1/1/2024 – 3/31/2024. Rates quoted above assume excellent borrower credit history and may be higher depending on individual credit rating. This special is valid for debt consolidation and credit card balance transfers only. A minimum disbursement of $15,000 for the Home Equity Line-of-Credit is required for a rate discount. A minimum of $5,000 loan disbursement with auto payment is required for signature loan special rate discount. Final rate is determined by credit score and term of loan. Maximum signature loan available is $30,000 based on credit score. All loan requests are subject to METRO’s lending guidelines. Rates are not available to refinance existing METRO loans.

Additional Home Equity Line-of-Credit Disclosures:

Processing fee of $400. Up to 80% Loan-to-Value financing based on qualification. Processing fee is non-refundable. Loan applications subject to METRO’s lending guidelines. Final rate is based on credit score and Loan-to-Value financing (LTV). *Listed rates for “A” credit financing. The Home Equity Line-of-Credit annual percentage rate is based on Prime Rates plus an added margin. The rate is subject to change January 1st and July 1st each year. The prime rate is currently 8.50% as published in the Wall Street Journal as of July 27, 2023. Minimum monthly payment is $100. Property values are based on the lesser of the current appraised value or a Freddie Mac Home Value Explorer (HVE®) with a condition report. Independent appraisals not accepted. Consult your tax advisor regarding tax-deductible interest. Rates subject to change. Savings account is required for credit union membership.