Auto Event

Drive More, Pay Less – METRO’s Auto Event

Auto Loans Made Easy at Metro

Rates as low as 4.29% APR*

Flexible Terms Up to 84 Months | Purchase or Refinance

Optional Add-ons: Low-Cost Loan & Vehicle Protection

Click APPLY NOW to submit your loan application and get PRE-APPROVED today!

Why Choose a METRO Auto Loan?

💰 Low Rates, Flexible Terms

Competitive rates starting at 4.29% APR* with financing terms up to 84 months.

🔄 Purchase or Refinance Options

Whether you’re buying new, used, or refinancing your current loan—we’ve got you covered.

🛡️ Low-Cost Auto Protection Add-ons

Save more with Member Loan Protection, GAP Coverage, and Mechanical Repair Coverage.

👥 Metro Member Perks

Enjoy personalized service, faster approvals, and exclusive credit union benefits.

🔒Protect Your Loan & Vehicle – the Smart Way

All options are designed to keep your finances safe without breaking your budget. CLICK HERE For more information!

Additional Terms and Conditions:

*Rates and offers are current as of 04/01/2025 and are subject to change. Final rate for all collateral loans is based on credit score, amount financed, year of vehicle, and term. Term will vary by year of vehicle and amount financed. Rates quoted assume excellent borrower credit history with 15% down payment and may be higher depending on individual credit rating.

New Auto Loans: The loan rate applies to New Vehicles only. New Vehicles are those for which you are the original owner and the UNTITLED vehicle is model year 2024 or newer with less than 3,000 miles. Up to 125% financing is available with an added premium. Vehicle weight and mileage restrictions apply.

Used Auto Loans: Metro will determine the Maximum used car loan using a JD Power value. Financing is available up to the JD Power valuation, not to exceed 125%. Vehicle weight and mileage restrictions apply.

Payment Example: The approximate monthly payment on a $25,000 loan at 4.99% APR (rate discount included) for 60 months is $471.58. The total finance charge is $3,294.27, and the total loan cost is $28,294.27.

Rate Discounts: A .50% rate discount will be applied to Auto Loan rates with a down payment of 15% or more. The rates above include the rate discount.

APR = Annual Percentage Rate. Your actual APR will be determined at the time of loan approval and will be based on your down payment, vehicle year, term, and credit information.

All loan applications are subject to METRO Federal Credit Union lending guidelines. Up to 125% financing is available with an added premium on vehicles that do not exceed 100,000 miles. The minimum loan amount is $20,000 for 72 & 84 months terms. Rates are not available to refinance existing METRO loans.

Browse Vehicles

Browse Vehicles Compare & Research

Compare & Research Get Pre-Approved

Get Pre-Approved

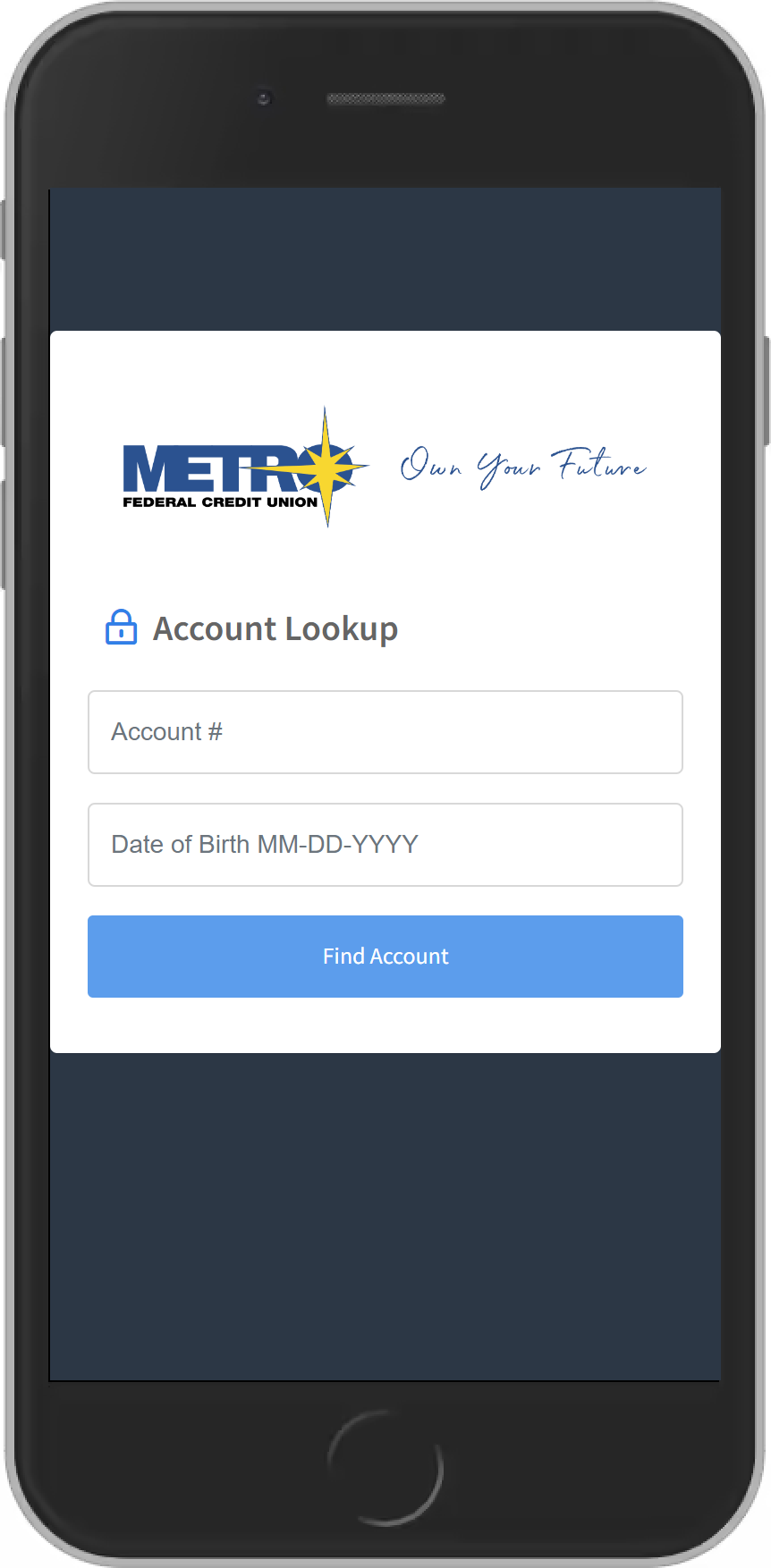

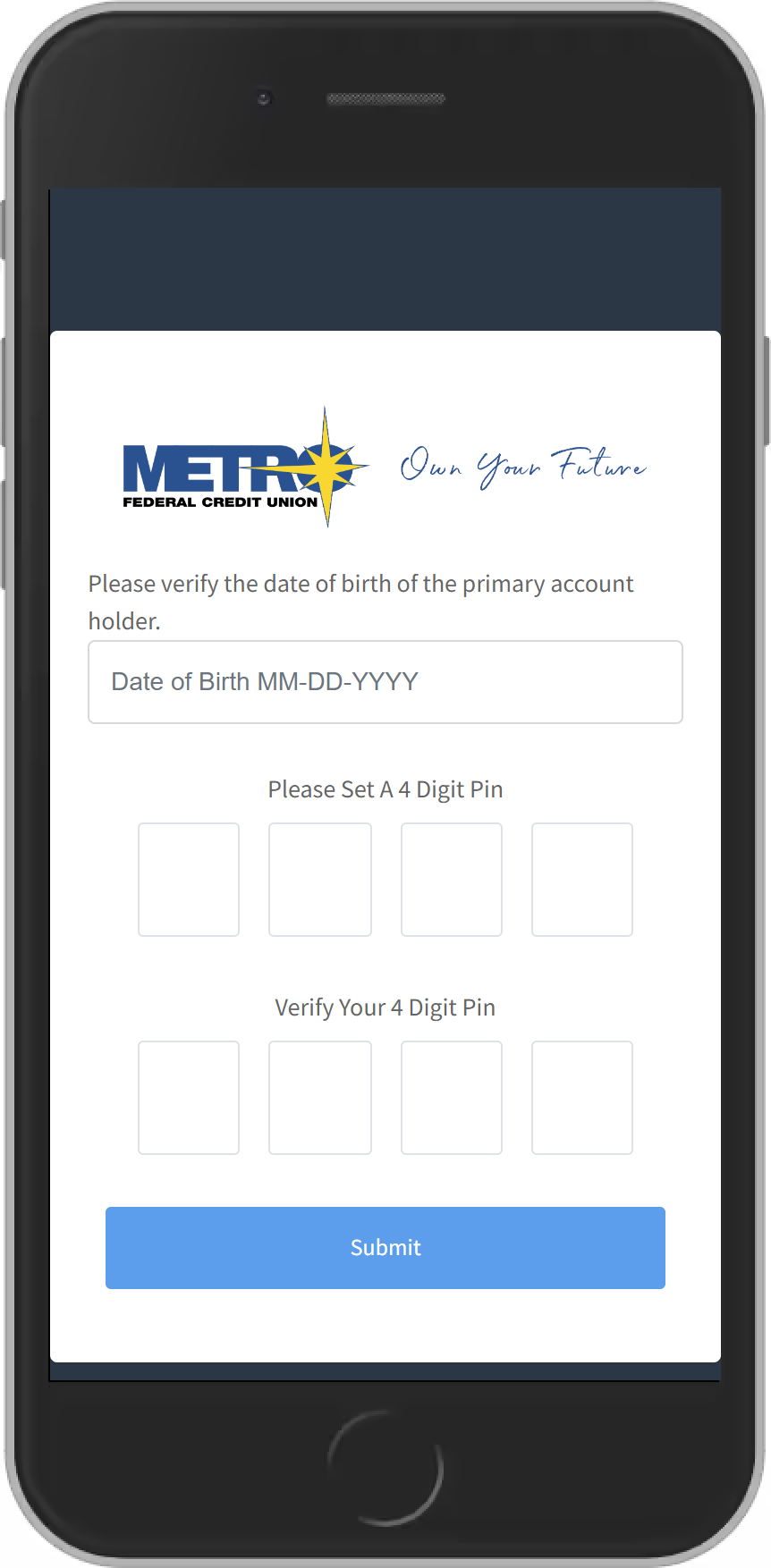

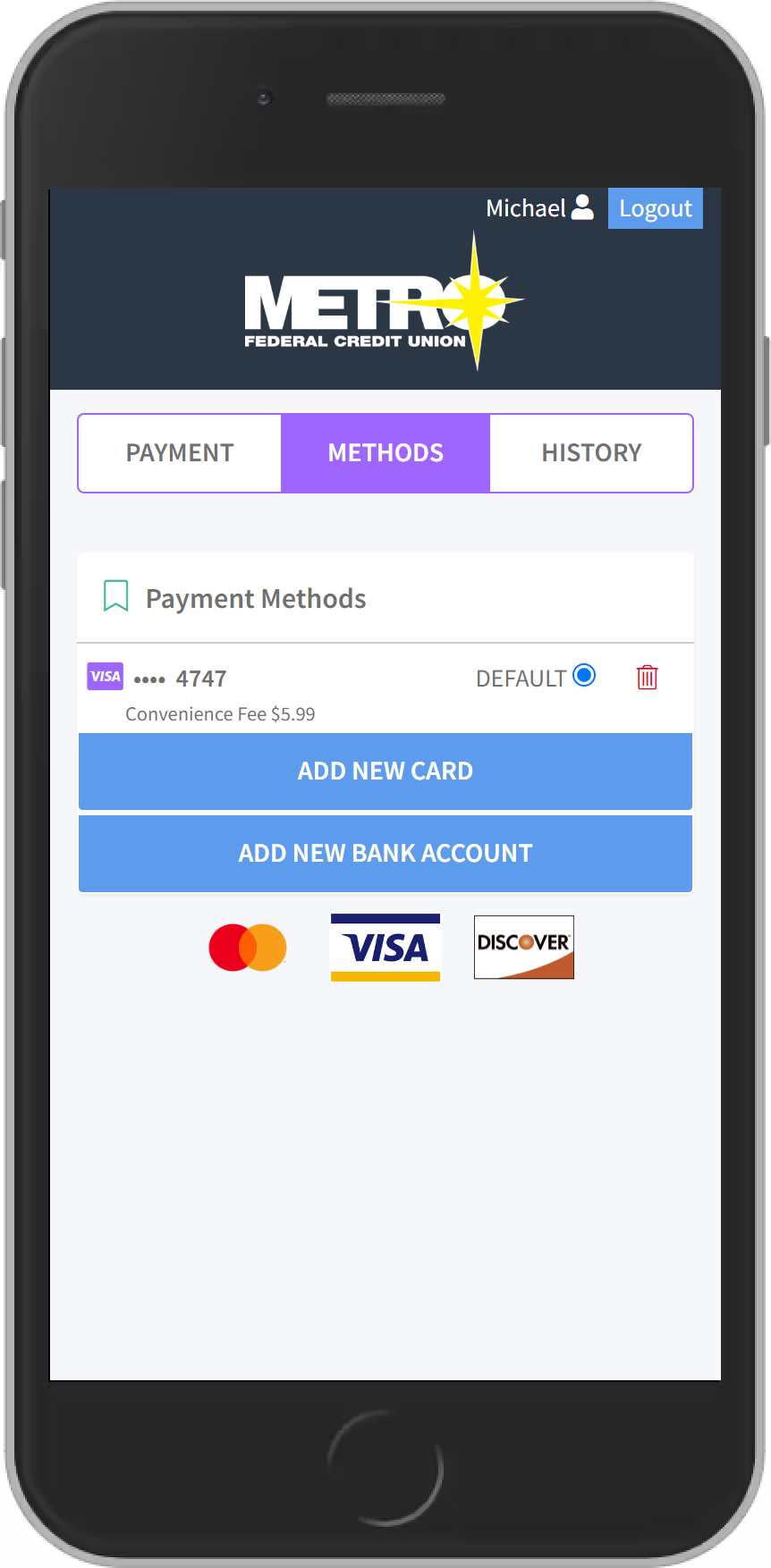

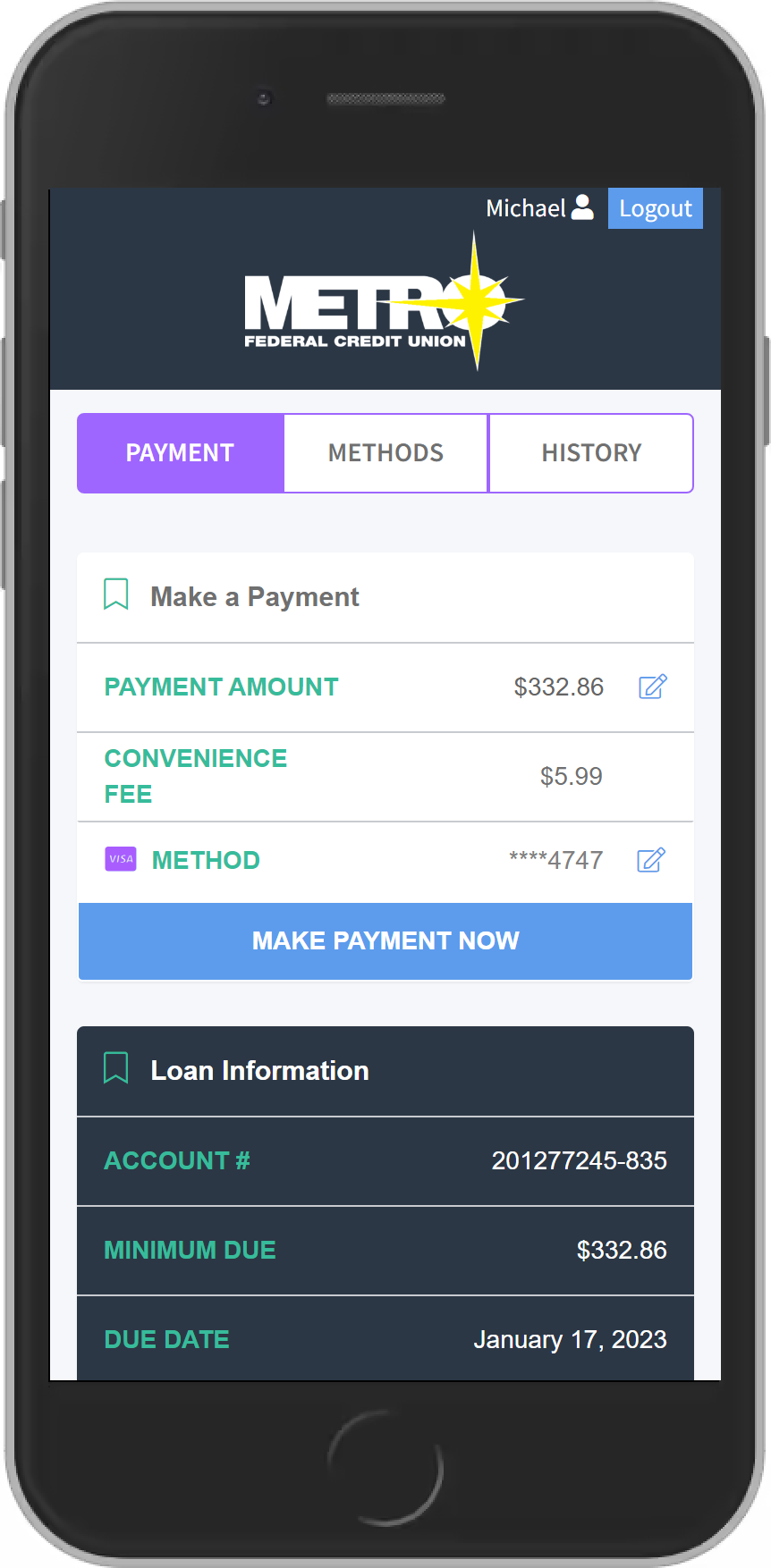

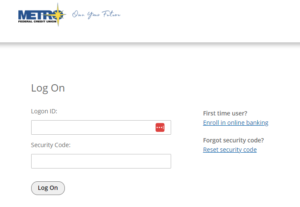

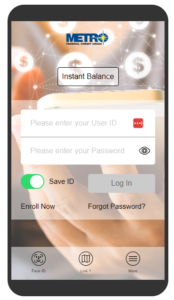

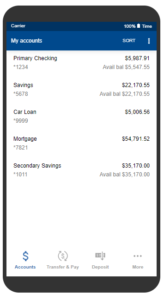

Make Easy Mobile Payments

Make Easy Mobile Payments