Membership Benefits Member Loan Protection

Given life’s uncertainties, it’s easy to see why more people are turning to financial protection to safeguard their family’s financial well-being.

METRO has the following options available to you to help with the unknown.

Guaranteed Asset Protection (GAP) PLUS with Deductible Assistance

GAP is a great option for vehicle loan protection for what your auto insurance may not cover for a wrecked vehicle! If your vehicle is deemed a total loss due to an accident or stolen, there can be a significant “gap” between what you owe on your loan and what your auto insurance will cover. GAP Plus helps you get into your next vehicle by reducing your next loan at the credit union.

METRO’s GAP Plus with Deductible Assistance is also designed to provide financial relief when your vehicle is damaged, but not deemed a total loss. If auto repairs cost more than your deductible, the deductible amount is applied to your loan, reducing what you owe.

View our GAP PLUS Digital Brochure here or learn more about the importance of financial protection with this infographic.

Talk to your Loan Officer to sign up and get protected!

Looking for more information?

Contact us at 847-670-0456, ext 2, to speak to a Loan Department Representative.

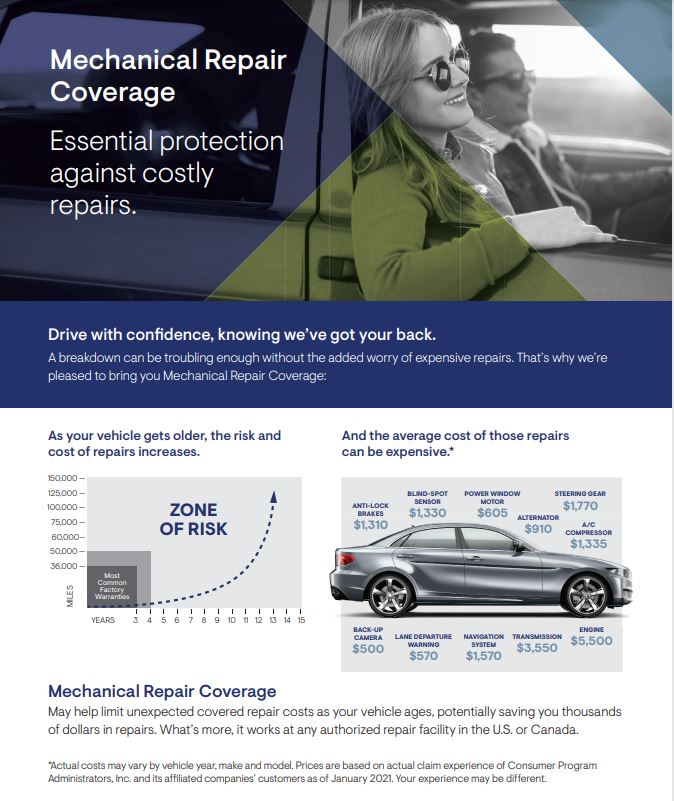

Mechanical Repair Coverage (MRC)

Essential protection against unexpected costs! As your vehicle gets older, frequent breakdowns mean costly repairs. Mechanical Repair Coverage can help limit those costs – and protect your finances. Find out which MRC coverage program is right for you!

Contact the Loan Department at 847-670-0456, ext. 2, for more information or for a quote!

Credit Disability Insurance and Credit Life Insurance

Protect the things that matter most. All METRO loans can provide the added security of Credit Disability Insurance and Credit Life Insurance. When your family experiences a hardship, the last thing they need is additional worry about how to pay your debts. Credit Disability and Credit Life Insurance may make your loan payments in the event of disability or even your death.

Credit Disability Insurance – Are you protected from the unexpected? Could you manage financially if your income was reduced or eliminated due to a disabling illness or injury? Credit Disability Insurance can help. It makes your monthly loan payment, up to the policy maximum, should you become totally disabled due to a covered illness or injury.

Credit Life Insurance – gives you a way to protect your loved ones from the unexpected. It reduces or pays off your outstanding loan balance, up to the policy maximum, if you were to die before paying off the loan.

Both include:

- Easy application

- No medical exam required

- Cost included in your loan payment

- Completely voluntary

- will not affect your loan approval

Enjoy the security that comes with being protected.

View our Credit Insurance Digital Brochure here or learn more about the importance of financial protection with this infographic.

Talk to your Loan Officer to sign up and get protected!

Looking for more information?

Contact us at 847-670-0456, ext 2, to speak to a Loan Department Representative.

Disclosure

Your purchase of MEMBERS CHOICE TM Guaranteed Asset Protection (GAP), which includes deductible assistance, is optional and will not affect your loan application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Your purchase of MEMBER’S CHOICE® Credit Life and Credit Disability Insurance, underwritten by CMFG Life Insurance Company (Home Office: Waverly, IA), is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Please contact your loan representative or refer to the Group Policy for full explanation of the terms. Base Policy Nos. CI-MP-POL, CI-SP-POL, B3a-830-0996, B3a-800-0695, B3a-800-0288, CI-MP-CE-POL; CI-MPOE-CC-POL; CI-MP-OE-POL; B3a-800-0992.

CA Only: Claims may be filed by contacting your credit union. If you have questions regarding your claim status, contact CMFG Life at 800.621.6323. California Department of Insurance Consumer Hotline: 800.927.4357.

VT Only: Claims may be filed by contacting your credit union. If you have questions regarding your claim status, contact CMFG Life at 800.621.6323. Only a licensed insurance agent may provide consultation on your insurance needs.

Unique ID & Copyright

CDCL-3415605.1-0121-0423 CUNA Mutual Group ©2021, All Rights Reserved