METRO’s Branded Mobile App is Here.

Mobile banking just got better at METRO!

Convenient access on-the-go using your cell phone! If you are a current Online Banking user, there are simple steps you can follow to take advantage of METRO’s Mobile Banking options, specifically our Branded Mobile App.

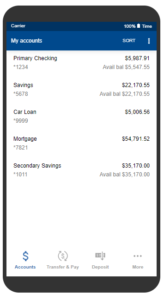

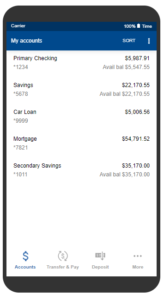

View your balances and history, transfer between your accounts, pay bills, deposit checks, send money via ZELLE, and much more!

Download the app from one of the app stores:

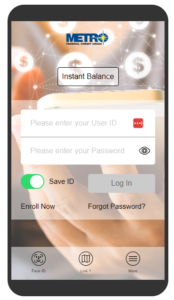

Mobile App Access

Stay connected on the go with METRO’s Mobile App. It’s free for any member with a checking or money market account.

Download and sign in…. it’s that easy!

- Download and use the METRO App – found on either the iPhone App Store or Google Play store above.

- Open the app and enter your login using your Virtual Branch Online Banking Logon ID and Security Code.

NOTE: You must be enrolled in online banking FIRST to use the mobile app. If you are not enrolled, CLICK HERE to get started!

If you haven’t logged in to our previous TouchBanking App recently, you’ll be prompted to upgrade to the “new version” when you relaunch your TouchBanking mobile app.

* Click on the “Update Now” button to be directed to your App Store.

* Download the METRO Branded App and sign in using your existing Logon ID and Security Code. (You will NOT need a mobile app code.)

* Once signed in to the updated app, you can delete the TouchBanking application.

What’s You’ll See:

| Modern Look & Login Screen | Simple Navigation | Overall Improved Look & Feel |

|  |  |

Online Bill Pay Users:

If you are a Bill Pay User, you will have access to view and pay your bills and enroll in Zelle person-to-person payments within the app.

Add Mobile Check Deposit!

With METRO’s Mobile App, you have the convenience of depositing checks using your smartphone! No ATM, no extra trip. Mobile check deposit is free and available for members with a checking or money market account.

It’s Easy! Just sign the Remote Deposit Application, and submit it to a friendly METRO Service Representative.

More Information

More Mobile Banking Options at METRO:

Mobile Browser

Provides access to our Online Banking site through a mobile web browser that is designed to fit the format of your cell phone screen. This option may be favored by customers who have a Smart Phone but do not utilize Apps. Users can bookmark the website for convenient access. To activate this feature, login to your Virtual Branch Online Banking, click on the Options tab, scroll down to the Mobile Banking Profile, click Manage Device(s) and follow the instructions to activate the Mobile Browser.

Text Banking

Receive real-time balances by texting ‘BAL’ and transaction history by texting ‘HIST’ to the designated number – 71806. A text response will be sent back to you with the requested information. No login information required! To activate this feature login to your Virtual Branch Online Banking, click on the Self Service tab, scroll down to the Mobile Banking Profile, click Manage Device(s) and follow the instructions to activate Text Banking.

Have additional questions?

Contact a Member Services Representative at 847-670-0456, ext 1, or contact us online.

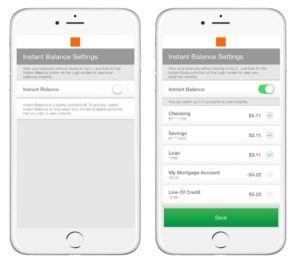

The Instant Balance feature lets you view

The Instant Balance feature lets you view

METRO Federal Credit Union is always working behind the scenes to ensure that your financial information is protected. With our Falcon Fraud Protection System, your debit and/or credit card transactions are analyzed as they occur. If suspicious activity or “out of habit” purchases take place, you will receive a phone call to confirm if the transaction is fraud or a legitimate purchase.

METRO Federal Credit Union is always working behind the scenes to ensure that your financial information is protected. With our Falcon Fraud Protection System, your debit and/or credit card transactions are analyzed as they occur. If suspicious activity or “out of habit” purchases take place, you will receive a phone call to confirm if the transaction is fraud or a legitimate purchase.